Landfill tax fraud continues to be a pressing issue posing significant challenges for waste management and environmental sustainability efforts. The imposition of taxes on landfill disposal was initially intended to deter excessive waste generation and encourage recycling and more eco-friendly waste management practices. However, fraudulent activities within this system have undermined its effectiveness, resulting in environmental harm and significant financial losses.

Understanding Landfill Tax

Landfill tax was introduced as a means to reduce the amount of waste sent to landfills, thereby mitigating environmental pollution and promoting recycling. The tax is imposed on the disposal of waste in landfills, with higher rates for materials that take longer to degrade or are more damaging to the environment. This economic incentive was designed to encourage waste producers to explore alternative methods such as recycling, composting, or energy recovery.

- The Issue of Fraud

Despite the noble intentions behind the landfill tax, fraudulent activities have plagued its implementation. Landfill tax fraud takes various forms, including but not limited to, misclassification of waste, illegal waste dumping, and falsification of records. One common method involves declaring waste as non-taxable or lower-rated material when, in reality, it should incur higher tax rates. This deceptive practice allows perpetrators to evade paying the appropriate taxes, leading to significant financial losses for the government – during a recent debate in the UK House of Commons it was suggested over a billion pounds of tax revenue was being lost each year, and this was thought to be a conservative estimate! To put this in context, this would pay for the Jobseekers Allowance in the UK for a year!

- Environmental and Economic Impact

The repercussions of landfill tax fraud extend beyond financial losses. Environmentally, the mismanagement of waste can lead to pollution of land, water, and air. Hazardous materials improperly disposed of in landfills pose a severe threat to ecosystems, human health, and wildlife. Moreover, the financial impact is substantial, depriving the government of crucial funds that could otherwise be allocated to environmental conservation or infrastructural improvements.

Efforts to Combat Fraud

Measures to tackle landfill tax fraud have been developed, including enhanced monitoring and enforcement plans, increased penalties for offenders, consideration of sophisticated technologies such as satellite tracking and surveillance to identify illegal waste dumping sites and catch perpetrators engaging in fraudulent activities, and the introduction of regulatory reforms. Notwithstanding these developments national and regional authorities continue to struggle to get to grips with the problem due to inadequate resourcing and an apparent lack of prioritisation between law enforcement agencies, waste management companies, and regulatory bodies.

Challenges and Future Outlook

Despite all of these efforts, many challenges persist. The complex nature of waste management, coupled with the adaptability of fraudulent tactics, presents an ongoing challenge for authorities. Organised crime involvement, sophisticated schemes, differing approaches and emphasis across local authority areas add layers of complexity to combating this issue effectively.

Looking ahead, a multifaceted approach involving technological advancements, policy enhancements, and international cooperation is crucial to effectively curbing landfill tax fraud. Emphasizing prevention through education and awareness, coupled with stringent enforcement and regulatory measures, can play a pivotal role in mitigating the detrimental effects of fraudulent activities within the waste management sector.

However, while awaiting the deployment of more sophisticated responses, a simple “low-tech” solution involving visual inspections by experienced technicians of all loads arriving at landfill sites to ensure they are being appropriately categorised would address many of the above issues immediately. And given the size of revenue fraud involved and the instant return this would provide means the positive cost benefit of appointing these resources is obvious.

Conclusions and Immediate Next Steps

In conclusion, landfill tax fraud remains a significant concern undermining the objectives of waste management policies and posing environmental and economic risks. Addressing this issue requires sustained efforts, collaboration across sectors, and innovative solutions to safeguard the environment and ensure fair and effective waste management practices.

In terms of immediate next steps: the starting point to tackle this significant environmental and financial problem is the urgent need to revisit previously developed strategies and governance structures. This process must focus on defining shared outcomes and ensuring respective agency responsibilities and targets are clearly defined and agreed. Not until this has been done can any meaningful progress be made to address this regional, national, and international problem.

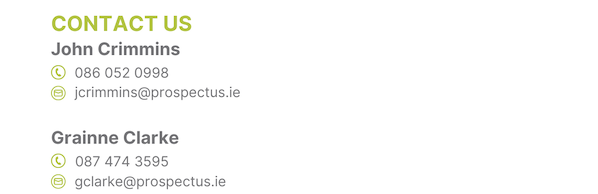

John Crimmins is the Managing Director at Prospectus Management Consultants, and has over 20 years’ experience supporting organisations to develop and implement innovative multi-agency strategies.